Quarterly options, index options, index future, index future options all went through expiration Friday and not much happened again. Somehow all attempts to go just a little lower for the broad market always met with one of the big techs going higher like a penny stock to offset all the losses from the other 99% of the stock market. In particular, this Friday we have Nvidia going higher and so the indices just stuck in place and close near their opening prices.

Next week we have line up of many market moving events like WW3, financial system total collapse, etc. but none of that matters until they do. So no point guessing which way it will go … that’s the beauty of day trading – taking it one day at a time.

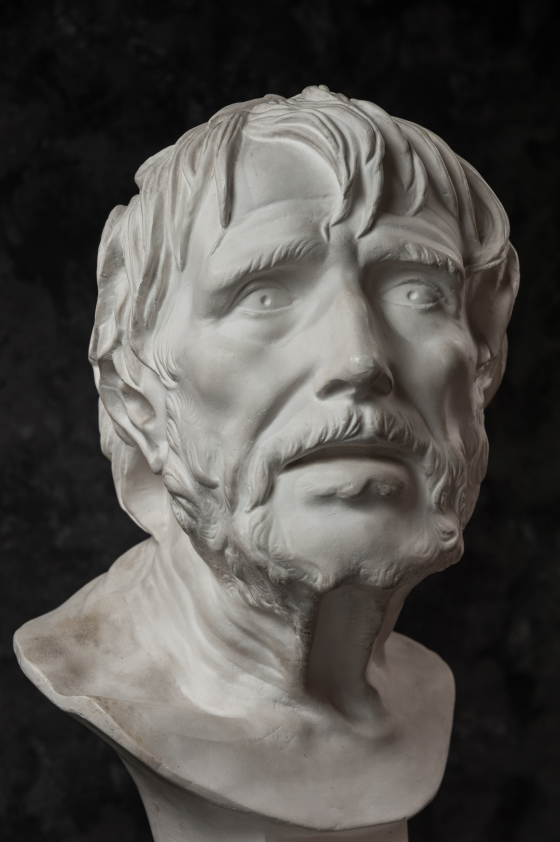

I came across this video talking about moral code from Immanuel Kant. Pretty good explanation that helps people to at least giving the concept a thought.

I thought about going to Antarctica for a long time. If anything it is definitely on my bucket list. And I found this video talking about a cruise going there in comfort. What a nice surprise.

For those concern much about the financial markets, here is a video of Lyn Alden talking about her take on the current situation. It is an hour long video and many topics are covered. As usual, I do not necessary agree with the opinions in these videos. It is just good practice to observe what influential people think about the markets because they affect the behaviour of many people who follow them.

Here is a great video for those of you young adults or those who have kids. The world is changing and whatever people who are still alive believe in of the social norm or a good path going forward are all wrong. The currently alive 4-5 generations of people have no idea that this 9th phase (20 years starting now) of the 180 years cycle according to Chinese feng shui will do to them all. When I get the chance, I will write something up on the subject.

Back to work as usual.

Have a great weekend all!